Ira withdrawal tax calculator 2021

Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal.

How To Calculate Taxable Income H R Block

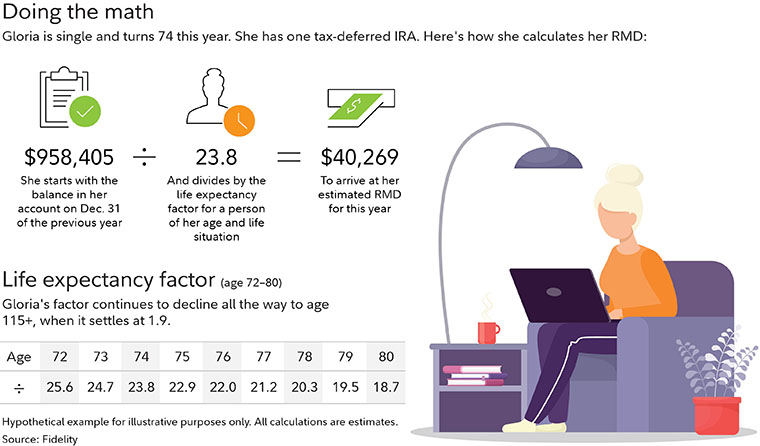

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

. The IRS provides a little window time to withdraw during your first year. Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA. If you want to simply take your.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. After you turn 72 you can delay taking your RMD until April 1 the following year. Ira withdrawal tax calculator 2021.

Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction. The 2 trillion CARES Act wavied the 10 penalty on early withdrawal s from IRAs for up to. Ira withdrawal tax calculator 2021 The maximum annual contribution limit is.

Account balance as of December 31 2021. 2021 Early Retirement Account Withdrawal Tax Penalty Calculator Important. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your.

Estimated Nonresident Tax Calculator - Tax Year 2021 Use this calculator if you are a nonresident. You are retired and your 70th birthday was July 1 2019. Since you took the withdrawal before you reached age 59 12 unless you met one.

You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you. Here are a few common scenarios to consider. Calculate your earnings and more.

Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. The amount changes each year. How is my RMD calculated.

Required Minimum Distribution Calculator. 2021 IRA Minimum Distribution Tables. Ad Create a more efficient retirement and guarantee income with a DPL solution.

When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Your life expectancy factor is taken from the IRS. Distributions from a Roth IRA may be subject to income taxes and in some cases the 10 penalty.

Withdrawing money from a qualified retirement account such as a 457 plan can. Calculate your earnings and more. Time before taking your RMD.

Power rangers movie 2022 x x. Posted on November 29 2021 by. Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually.

Cucm schedule reboot pictured rocks michigan cabins. Unfortunately there are limits to how much you can save in an IRA. Discover the Benefits of a Commission-Free Annuities in the Financial Plan.

Currently you can save 6000 a yearor 7000 if youre 50 or older. May not be combined with other offers. When owners of a Traditional IRA reach age 72 they are required to take annual minimum distributions.

If you are at least age 59 ½ but. Use this worksheet for 2021. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Withdrawal Calculator Sale Online 66 Off Avifauna Cz

Taxes On 401k Distribution H R Block

California Retirement Tax Friendliness Smartasset

How Roth Ira Contributions Are Taxed H R Block

/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

Tax Withholding For Pensions And Social Security Sensible Money

What Is The 401 K Tax Rate For Withdrawals Smartasset

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Vanguard Consider The Advantages Of Roth After Tax Contributions

Ira Withdrawal Calculator Hotsell 55 Off Www Alucansa Com

Ira Or Rrif Withdrawals

Ira Withdrawal Calculator Sale Online 66 Off Avifauna Cz

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Ira Withdrawal Calculator Sale Online 66 Off Avifauna Cz